Overview

With new developments arising over the respective regions, here are our market highlights for last week.

China

Reverse repo resumes after a two-month break while loan prime rates stay put

After two-months of halting, the Chinese central bank has resumed 14-day reverse repo operations for the first time on 21/8. In this operation, a total of 200 billion yuan has been injected into the banking system through open market operations. Among this 200 billion yuan, 150 billion yuan will be injected as seven-day reverse repos, while the remaining 50 billion yuan will be injected in a 14-day tenor.

The Chinese central bank’s series of reverse repo are seen by the market as policies to boost the Chinese economy, which has been already battered by the recent floods and geopolitical tensions with the US.

While reverse repo started again, the Chinese Central bank did not cut the 1-year and 5-year loan prime rates, which stay at 3.85% and 4.65% respectively. This is in line with expectations as the bank commented earlier that its monetary policies will be more flexible and specific to give liquidity to corporations that are critically damaged due to the COVID-19 pandemic.

For the rest of 2020, it is expected that the Chinese monetary policy will be relatively dovish due to geopolitical tensions despite the stabilization of Covid-19 infection cases in the nation.

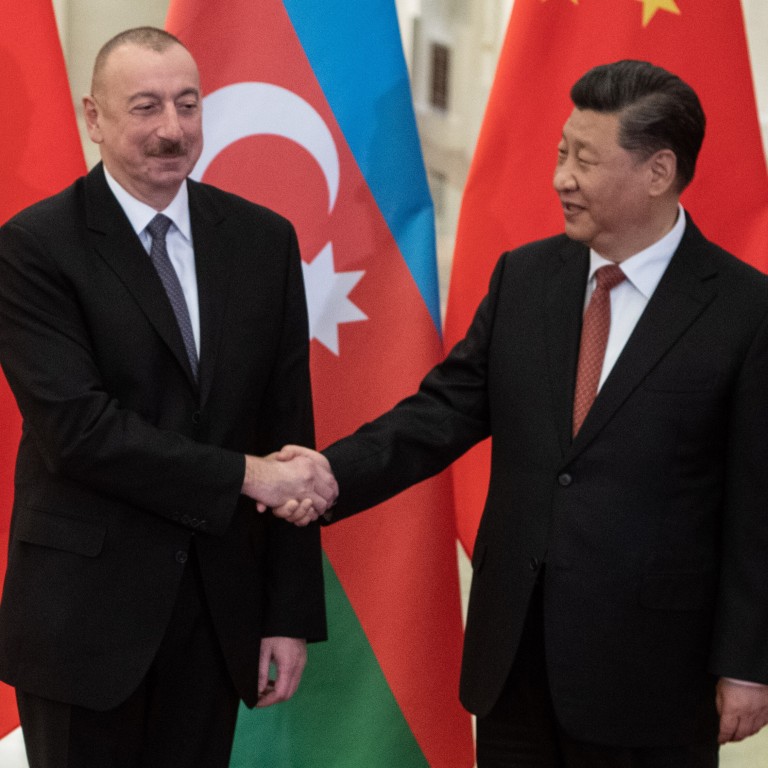

Update on Belt and Road Initiative: China to work with Azerbaijan

China’s interest in Azerbaijan started years ago, but the Belt and Road initiative accelerated and intensified it. Beijing seeks to maximize the potential of Azerbaijan’s strategic position in Central Asia through investing in the nation via the Belt and Road initiative. China has been pushing for opening up access for projects under its belt and road initiative by utilizing Azerbaijan’s on-going bilateral negotiations on WTO membership.

Since the plan to grow global trade in 2013, China has long been actively seeking market access partnerships with other belt and road countries that want to join the WTO. Take Azerbaijan as an example, one project that involves the nation is the Trans-Caspian International Transport Route, which is a land transport network spanning from China and Southeast Asia all the way to Europe. This project is a part of China’s plan to replicate the ancient Silk Road that connected China to the rest of the world.

United Kingdom

Stronger than expected economic data but debt balloons

July CPIH was 1.1% YoY which was 0.3% higher than last month’s figure and smashed consensus expectations of a modest 0.6%. Recreation and culture was the biggest contributor (0.33 pp) while other notable increments came from clothing, furniture and household goods on top of higher prices stemming from rising petrol prices.

Meanwhile, July retail sales notched 3.6 % YoY beating market expectations of 2% and has now returned back to pre-pandemic levels. Despite a spike in non-food sales and fuel trade (10% and 26.2% respectively), food sales fell 3.1%. However, this is due to the EatOutToHelp scheme which lowered the overall consumer’s retail food bills.

Elsewhere, August PMI gave a preliminary reading of 60.3 which reflects an increase in new orders and production. A pick up in numbers is expected as a further easing of lockdown measures meant that more businesses can reopen while the public gradually returns to the high street.

Overall, the improvement in economic data seen above is the result of increased consumer spending due to the unwinding of lockdown measures. Thus, as long as COVID cases are well contained, we can expect the continuous improvement of the economic data and a more optimistic economic outlook in the following months. Notably, public sector debt has ballooned to £2 trillion which is alarming but for now, recovery is of utmost importance.

EU

A weak economic outlook for the EU

This week, Italy’s GDP in the second quarter was better than economist forecasts albeit a record contraction while PMI increased for the first time in two years. Experts attributed this to the government’s success in assisting businesses during the pandemic through stimulus packages. However, investors are not optimistic as these economic improvements are dependent on an increase in domestic demand right after lockdown and might not last.

On the other hand, Spain recorded an 18.5% contraction and France recorded a 13.8% contraction in their respective economies.

Overall, the Eurozone’s economic outlook is weak as recovery appears to be losing momentum. PMI levels decreased in August and went below market expectations while COVID-19 cases are almost back to May levels, triggering new quarantine requirements and localised lockdowns. Moreover, ECB warned that unemployment rates in the Eurozone will likely have a sharp increase as reopening plans are put on hold.

United States

US Jobless Claims rise again

New claims for US Unemployment benefit rose back above 1 million last week as layoffs began picking up pace again which is a worrying sign for the labour market in the world’s largest economy. There were 1.1million initial jobless claims on a seasonally adjusted basis for the week ending on August 15. This figure is higher than the predicted 925 000 and has come as a surprise as the week before showed that the initial jobless claims fell below 1 million for the first time since the pandemic affected the labour market in March.

This news may put further pressure on policymakers as the White House and Democrats are at a standoff when it comes to fiscal policy. Whilst Trump recently signed off on four executive orders in order to relieve the economy from the effects of COVID-19 the money has not yet moved in any significant amount. There is also a major stand between the two major American parties with regards to fiscal stimulus. On one hand, Democrats want to extend emergency jobless benefits of $600 per week which expired in July however the Republicans have proposed to cut the amount down to $400. Those affected are seemingly frustrated by this debate with no real indication of when they will receive this benefit as well as the proposed new round of stimulus cheques.

This news comes as a disappointment as the US economy is desperate for signs of improvement and with the week before seemingly showing signs of improvement in the labour market this new information still goes to show there is still a long road ahead before any form of significant recovery comes to light.