Overview

With new developments arising over the respective regions, here are our market highlights for last week.

China

Digital Currency in China

China’s digital currency is set to roll out in 3 regions including Beijing-Tianjin-Hebei region, Yangtze River Delta, and the Greater Bay Area. The Digital Currency/Electronic Payment (DCEP) or “China’s digital yuan” will be the first-ever sovereign digital currency to be rolled out.

Like the majority of the world, China mainly relies on the U.S. dollar payment system to engage in international deals, thereby making them vulnerable to possible U.S. sanctions. The Chinese government has long been developing digital currency as a way to mitigate the risk of heavy reliance on the U.S. dollar. With the launch of the digital currency, China can shift away from U.S. dollars and bypass international financial systems subjected to U.S. law.

Hong Kong

Hong Kong’s recovery has a long way to go

An announcement this week has stated that Hong Kong’s economy contracted by 9% in the second quarter on a year-to-year basis. While this figure is marginally better than the 9.1% last quarter and is considered in line with Government predictions, this marks as the fourth consecutive quarter of year-over-year decline in GDP. In addition, the cuts in the full-year economic forecast by the Hong Kong government, from shrinkage of 4%-7% to shrinkage of 6%-8%, mark the pessimistic outlook on the Hong Kong economy.

According to the Hong Kong government, the rationale behind the cuts in year-end GDP could be attributed to the recent flare-ups of COVID-19 in Hong Kong. In fact, as of 16th August, the number of COVID-19 cases reaches 4407, nearly tripling from a month ago.

This new wave of outbreak, which started in July, caused the government to tighten social-distancing measures. These measures include enforcing social distancing, banning social gatherings and restricting dine-in services at restaurants. These measures have reduced consumer consumption significantly, leading to huge drops in economic activities.

While Hong Kong’s economy is expected to rebound in quarter 3 and 4, some economists fear that if the current wave of local infection cannot be contained within a short time, economic performance for 2020 as a whole can dampen even more and hence missing even the newest economic target.

Hong Kong’s economy was already in a recession before the pandemic, partly due to large-scale pro-democracy protests and the U.S.-China trade war last year. While there are signs the outbreak is starting to be in control, these other factors may cause a lot of uncertainties along the way.

United Kingdom

Q2 GDP slump and further easing of lockdown measures

Last week, the UK recorded its worst-ever quarterly slump as Q2 fell 20.4% as there were widespread contractions across all sectors. Services fell 19.9%, Production shrunk by 16.9% and Construction contracted by 35%. However, this is expected as this period captures the bulk of when lockdown measures were first implemented before it was gradually eased in May and June. Moreover, this figure is especially large because consumer-facing sectors, which were hit the hardest, account for 80% of the economy and thus have a greater influence on the overall GDP number. Also, these sectors had a slower recovery compared to construction. Therefore, resulting in such a big quarterly recession.

On a positive note, Johnson has given the green light for the resumption of lockdown easing coupled with harsher punishments on rule breaches. With this in mind, we can expect Q3 figures to rebound significantly although there is now a greater need for vigilant monitoring of the “R” rate since most surges in COVID cases in other nations happened in the later phase of reopening.

Meanwhile, Remstein has said that the BoE is ready to step up its QE programme should the economy show signs of slowing. If anything, this is a clear signal of the BoE’s unwillingness to adopt negative interest rates.

Looking ahead, next week is a rather important week as July’s inflation reading and retail sales, as well as flash PMI, will be released.

EU

Negative economic indicators amidst economic recovery

In the past week, we saw an increase in Eurozone’s industrial production output but at a lower level than economists expectations. Markets became wary about Europe’s economic recovery as industrial production is still down more than 12.3% from a year ago.

Furthermore, COVID-19’s impact on the EU labour market is highlighted in an increase in EU unemployment numbers by 5.5million in the second quarter of 2020.

Beyond economic indicators, investors are also closely monitoring COVID-19 cases. Several governments have reimposed quarantine and testing requirements on travellers from popular holiday destinations. For example, the UK implemented new quarantine measures on arrivals from France due to the rising rate of COVID-19 cases there. As a result, European markets closed lower on Friday as investors are watching the possibility of a second wave closely.

United States

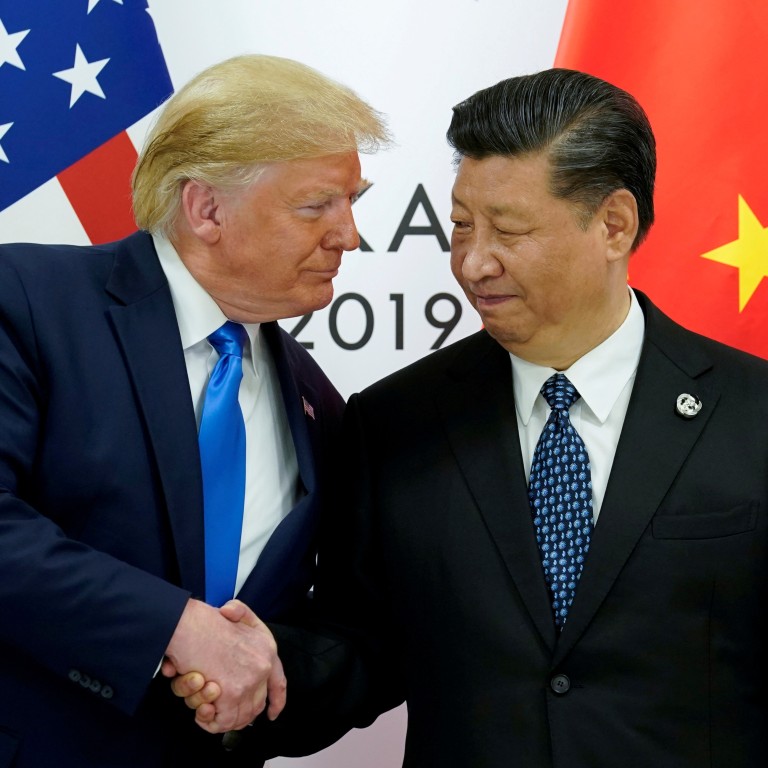

The US – China talk was postponed, a bad sign?

The US-China tension has embroiled the whole world since 2018. Peaceful talks between two parties have been very anticipated to happen on the 15th of August 2020 after early January where both countries agreed upon easing imported goods. However, it appears that this anticipated talk does not appear on both countries’ official calendar. Also, many events have happened that encourage this talk not to happen in the near future.

Just six months after a win-win agreement where China pledged to boost US imports by $200bn above 2017 levels including agriculture goods by $32bn and manufacturing products by $78bn and the United States agreed to halve some of the new tariffs it has imposed on Chinese products. The tension has risen not only because of the not happening anticipated talk but also the current pandemic situation that hits both countries’ economic stability. Therefore, China may be facing difficulties to boost the United States imports in both 2020 and 2021. The ban of Chinese apps in the United States, the Huawei issue, the closure of embassies in both countries together with the Hong Kong protest is some of the examples that further showcased the bad relationship between the two parties.